4

In 2025, global markets entered one of their most unstable phases in recent memory. Political decisions, trade strategy changes, and economic recalibration have triggered intense reactions across financial markets. For most people, this is something observed on the news. But for remote workers, freelancers, and digital professionals, it is personal.

When financial turbulence hits, office workers feel it through company policies months later. Remote workers feel it immediately — in portfolios, savings, client budgets, and crypto volatility.

The introduction of aggressive international tariff policies has shaken confidence worldwide. Investors are nervous. Supply chains are tense. And markets, as always, react before stability has time to return.

What makes this moment different is not the tariffs alone.

It is who is affected first.

And that group is the modern digital workforce.

Why Tariffs Terrorize Markets

Tariffs are not just tax adjustments. They are psychological detonators in the financial world. When governments alter trade policy suddenly, markets respond instantly because the future becomes unclear.

No investor likes uncertainty.

When tariffs change:

• product costs change

• corporate profits shift

• consumer prices react

• investor confidence shakes

• global supply chains reroute

The market does not panic over numbers.

It panics over unpredictability.

And unpredictability is the exact enemy of stability.

In 2025, reciprocal tariffs did not merely alter pricing structures. They destabilized expectation itself.

Remote Workers Feel Financial Impact Faster Than Employees

Office workers often rely on monthly income and employer-provided stability. Remote workers rely on flow. If the economy stumbles, remote incomes shift instantly.

Freelancers depend on:

• client budgets

• corporate spending

• startup funding

• digital growth

• currency flow

When markets fall, companies pause spending.

When companies pause, client work disappears.

Remote workers are not buffered by corporate contracts.

They are exposed directly to global risk.

This is why tariff chaos hits freelancers harder and faster than office employees.

Remote workers don’t just watch markets.

They swim inside them.

Trading Is No Longer a Hobby for Remote Workers

In 2025, online income is layered.

Most remote professionals no longer rely on one source of revenue.

They combine:

• freelance income

• consulting work

• digital products

• ETF investments

• crypto holdings

• passive income tools

When market volatility strikes, it is not just news.

It is a personal balance sheet conflict.

Remote workers track:

• portfolio value

• exchange rate shifts

• investment risk

• business expenses

• opportunity cost

A market crash is not abstract.

It starts with fear.

Then calculation.

Then reaction.

Chaos Creates Opportunity — But Only for the Prepared

The financial world obeys an uncomfortable truth:

Pain creates profit for someone.

Market crashes don’t destroy money.

They transfer it.

Remote workers who prepared:

• keep emergency funds

• diversify assets

• avoid emotional selling

• study cycles

• understand risk systems

They survive turbulence.

Some thrive in it.

In contrast, people who entered markets casually panic early.

They sell at loss.

They lock in damage.

And they abandon long-term position for short-term fear.

Markets in chaos do not reward emotion.

They reward discipline.

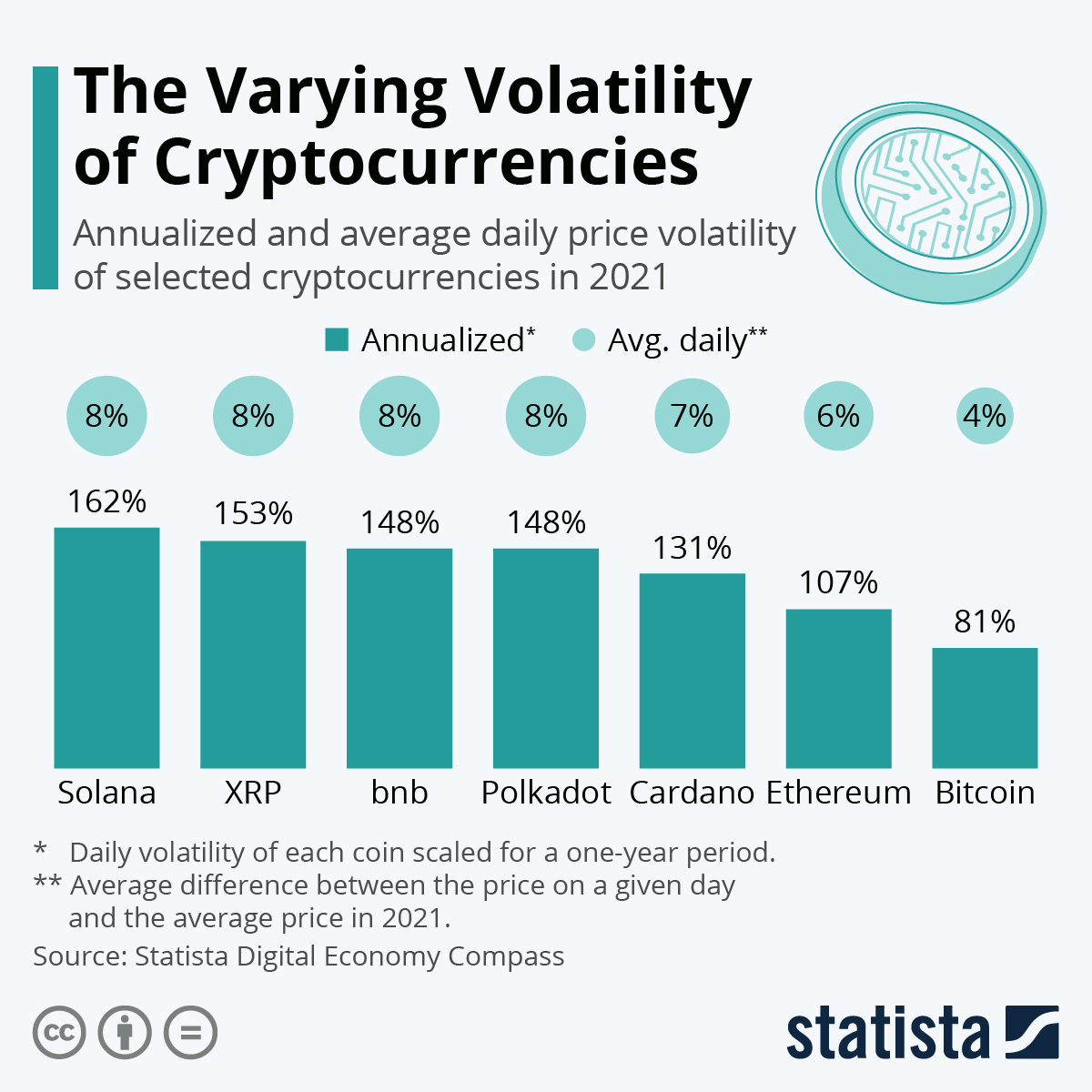

Crypto as a Chaos Magnet

Whenever governments disrupt trade systems, crypto absorbs attention.

Why?

Because digital money feels independent.

People assume:

“If governments shake the system, crypto escapes it.”

Reality is harsher.

Crypto does not escape volatility.

It amplifies it.

During uncertainty:

• prices jump faster

• losses strike harder

• timing becomes everything

Crypto is not a safe harbor.

It is a storm for those without strategy.

Remote workers who treat crypto as:

- lottery tickets lose

- diversification win

The difference is not knowledge.

It is risk control.

How Skilled Remote Workers Are Reacting

Experienced freelancers and digital professionals do not “day trade the news.”

They reposition.

Common strategies during market panic:

1. Holding Liquidity

Cash becomes power in chaos.

2. Spreading Exposure

No portfolio relies on one sector.

3. Leveraging Long-Term Assets

Short-term panic does not erase long-term value.

4. Reducing Leverage

Debt multiplies risk. Smart workers shrink it.

5. Upskilling

When economy shrinks, skill value increases.

Remote workers invest in:

• automation

• marketing skills

• AI literacy

• scalable services

Market Fear Reshapes Freelance Demand

When companies fear recession:

• projects are delayed

• budgets shrink

• marketing drops

• hiring slows

Remote workers adapt quickly.

They:

• renegotiate prices

• change niches

• expand offerings

• target safer industries

Some sectors explode during crisis:

• cybersecurity

• automation

• compliance

• digital infrastructure

• cost optimization services

The remote economy does not die in recessions.

It mutates.

The Psychological War of Economic Noise

In global panic, another market explodes:

Attention.

News cycles intensify.

Social media multiplies fear.

Influencers scream predictions.

Remote workers who overconsume panic:

• trade emotionally

• react impulsively

• abandon strategies

• chase rumors

• misallocate funds

The best investors:

• read less

• analyze more

• react slower

• plan further

Mental clarity becomes a financial weapon.

This Is Bigger Than Politics

Tariffs are a symptom.

The real shift is:

Global economic rebalancing.

Remote workers are not reacting to tariffs alone.

They’re witnessing:

• supply chain realignment

• digital labor globalization

• remote workforce normalization

• economic decentralization

Markets are rewriting rules.

Workers must learn them.

The New Role of the Remote Worker

The modern freelancer is:

• not just a worker

• not just a contractor

• not just a service seller

They are:

• independent economic units

• microbusiness owners

• personal finance strategists

• portfolio managers

• global contractors

Remote workers in 2025 are financial citizens.

Not spectators.

What This Moment Teaches (And It’s Harsh)

Market chaos exposes weakness.

It also reveals intelligence.

This moment teaches:

• Do not depend on one income

• Do not trade emotions

• Do not ignore learning

• Do not trust blindly

• Do not equate calm market with safety

• Do not think markets are “too big” to understand

Financial literacy isn’t optional now.

It’s oxygen.

Final Perspective

In 2025, tariffs didn’t just shake headlines—they shook wallets, careers, and confidence. Markets pushed remote workers to rethink everything: how they earn, invest, and protect what they build. Some lost money. Some gained discipline. Others learned lessons that no course could ever teach. The global economy is not emotional or forgiving—it is exact. When you understand how it moves, it rewards strategy and patience; when you guess, it collects the price in mistakes. Your workspace is no longer just where you work—it’s where you make financial decisions every day. Your desk is not a desk anymore. It is a financial cockpit. And from that seat, you either drift blindly into turbulence, or you learn to read the instruments and fly with control.